BlackRock’s Bitcoin ETF climbs to top 1% in record-breaking 211 days

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed every exchange-traded fund (ETF) launched in the past decade in terms of total assets.

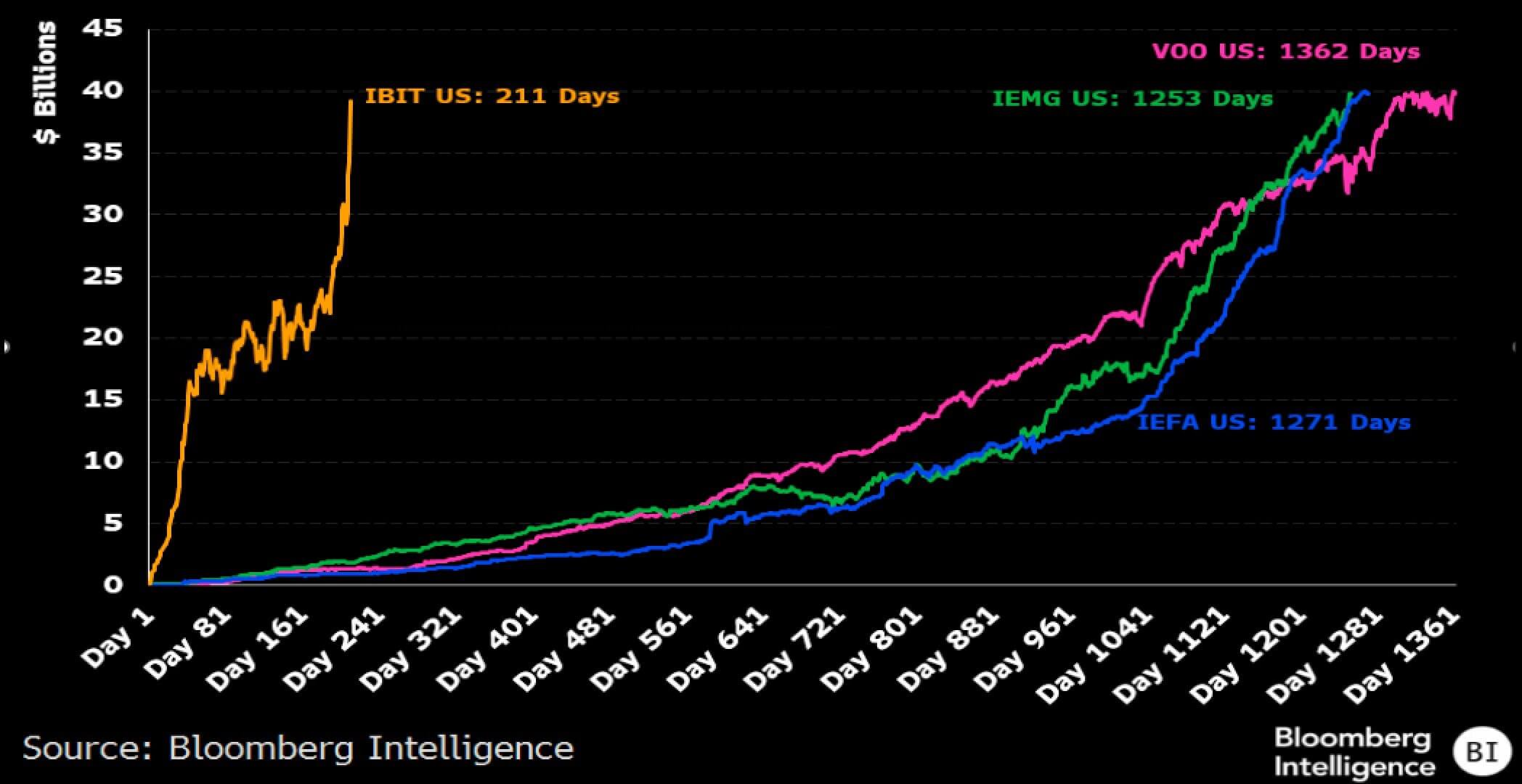

On Nov. 13, Bloomberg’s ETF analyst Eric Balchunas reported that IBIT reached $40 billion in assets— just two weeks after hitting $30 billion. This achievement came in a record 211 days, almost 6x lower than the previous record of 1,253 days set by the iShares Core MSCI Emerging Markets ETF (IEMG).

At just 10 months old, IBIT has already become one of the top 1% of ETFs by assets. It has surpassed the total assets of all 2,800 ETFs launched over the last ten years, a remarkable achievement considering most ETFs take years to accumulate substantial value.

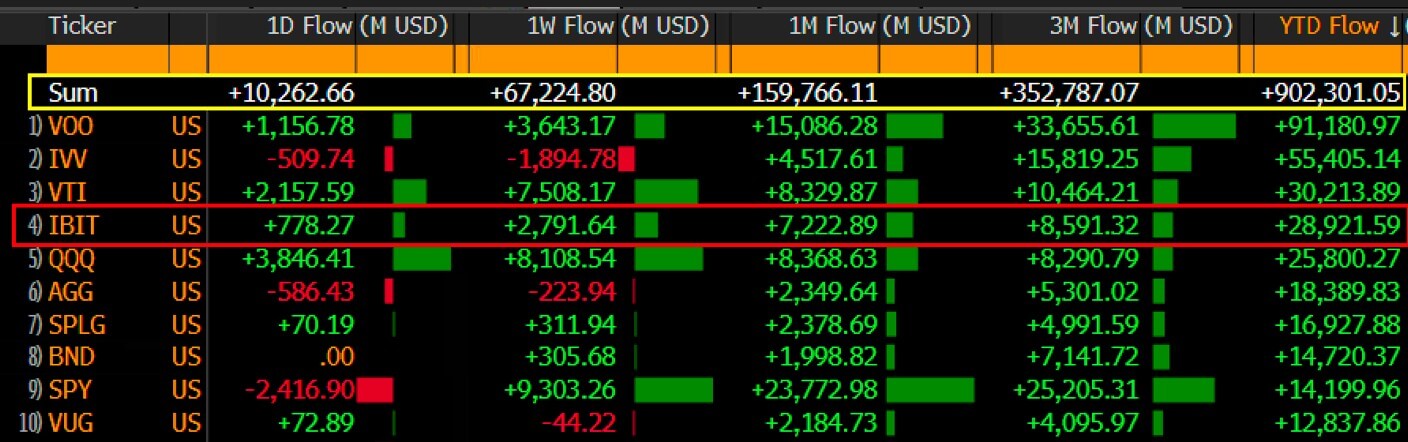

Meanwhile, IBIT also stands fourth among US ETFs for 2024 inflows, having attracted more than $28 billion so far. It is the only crypto-related ETF in the top 10.

These impressive numbers highlight the increasing demand for Bitcoin exposure in mainstream investment portfolios. Its success also suggests strong momentum behind digital asset ETFs, which may become a lasting fixture in traditional finance.