The GameFi Problematic

What was charming for GameFi?

The concept of GameFi, a combination of game and finance, projected a major paradigm alteration when it first came out as a successor to DeFi. This was a concept that belonged to the new web3 world; where the dominance of big game companies has come to an end, where players can acquire their “real” assets…

Although it sounds exciting, it has been discussed what it will bring to the conventional gaming experience: Is it really such a big concept that literally possessing your character in the game? For some, no need.

However, the number of those who advocate this concept for a decentralized virtual world is not small at all. Moreover, this industry is branching day by day despite the micro & macroeconomic conditions. We can talk about the basic and effective benefits that GameFi offers us at first glance: property rights and disposal of game assets, liquidity in secondary markets, governance capacity, and the ability for players to expand their domains to other ecosystems using Soul-Bound-Tokens and so on.

The Problematic of Go-to-Market Strategy

GameFi followed a go-to-market strategy at first, with the promise of an economic model. They tried to increase the user population, and while doing so they used token as a reward system. The model used for GameFi when the games were launched was actually nothing but the distribution of tokens as rewards.

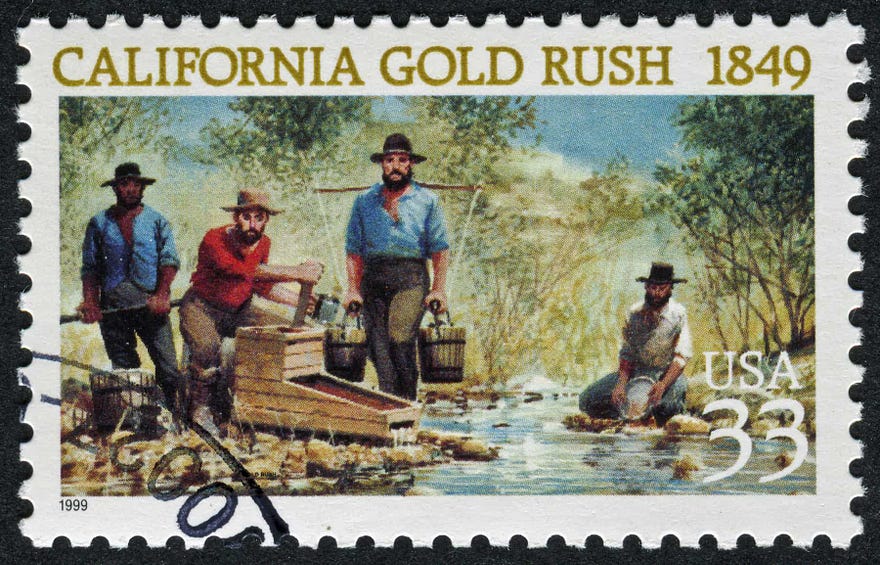

This is kind of a “Gold Rush” period which is lived in modern times, for both instantly valuable in-game currencies and NFTs.

But after a while, as the number and participating pace of new entrants dwindled, there was no new demand within the economy to sustain the increased supply needed to pay the rewards. Then, that “rush” also reversed, both for in-game currencies and NFTs; then, their prices began to crash. This was the negative result of the go-to-market strategy, and it has left an unsustainable structure behind.

Circulation & Sustainability Problem

There is an ongoing difficulty for Web3 games in today’s market. Whether play-to-earn or free-to-earn; the circulation and sustainability problem stands there as one of the biggest reasons for the skeptical view on GameFi. If a game is free-to-earn, a new player comes in for free, and s/he creates value within the game’s ecosystem and converts it into fiat currency. This is the way that one can make money from a GameFi project.

However,

The value that you can create depends on the hardly volatile crypto prices and the market conditions. When Bitcoin and the others’ prices decrease, the asset that you earn from the game also decreases. (It highly-likely

stems from the cryptocurrencies that did not complete their regulation, so they are still not used in a wide range of populations yet.)

The other factor that grows the problem is that users who consider a GameFi project for gaining a huge amount of money as soon as possible. Those people who are generally not so much interested in gameplay or the quality of the game, make it problematic to provide a sustainable GameFi economy. This is true for both the so-called degens and conventional gamers who prioritize the gaming experience. A common issue of players within the play-to-earn concept was that the “earn” side of the games was getting ahead of the “play” part.

In this regard, current play-to-earn games are viewed by players as “games that are not enjoyable and whose story cannot fulfill the player’s game experience.” [Then yes, for now, it cannot be said that the actual popular GameFi projects (like Axie Infinity) relatively do not have satisfactory gameplay and gaming pleasure.]

The palliative treatment seems to be: The quality of the games should increase, and players should focus on the pleasure of playing the game, not on making money and getting rich via GameFi.

So, this newborn and exciting concept should/may change from play-to-earn to play-and-earn.

Well, do big and conventional game companies enter this sector with all their experience and knowledge; and accelerate the GameFi transformation?

Maybe or not.

Yes, they enter; because although it is still early, there will be a big investment area in the long term within the framework of the “Web3 transformation”.

No, they don’t; because there’s a risk of failure and they don’t want to take it for prestige or financial reasons (at least during the current bear season, when sectoral crises (FTX, Luna) erupt in a row).

Game Engine’s Predictable Miracle

Open-code game engines also can be accelerators for this course.

With the help of game engines, developers now can more easily and efficiently build high-quality games without incurring the enormous time commitment and costs necessary to build the underlying game engine from scratch.

Thus, time and energy savings can be obtained from the time and other technical details. These can be spent to create more immersive and enjoyable games. Today, game engines such as Unreal Engine, Unity, CryEngine, Amazon Lumberyard, etc. perform quite successfully on this. This means that games that are visually well-designed, that can be connected with the story of the game, and that have an authentic game atmosphere can be created more easily.

The year 2021 was not so bad in many aspects for GameFi. NFT hype was driving the market, but it seems to have dwindled by now. Million-dollar NFTs are now trying to find buyers for several hundred dollars. Then, it naturally affects GameFi also because it seems they are inevitably integrating with each other. Moreover, the endurance of both of them is perhaps due to their merging with each other.

Reviews