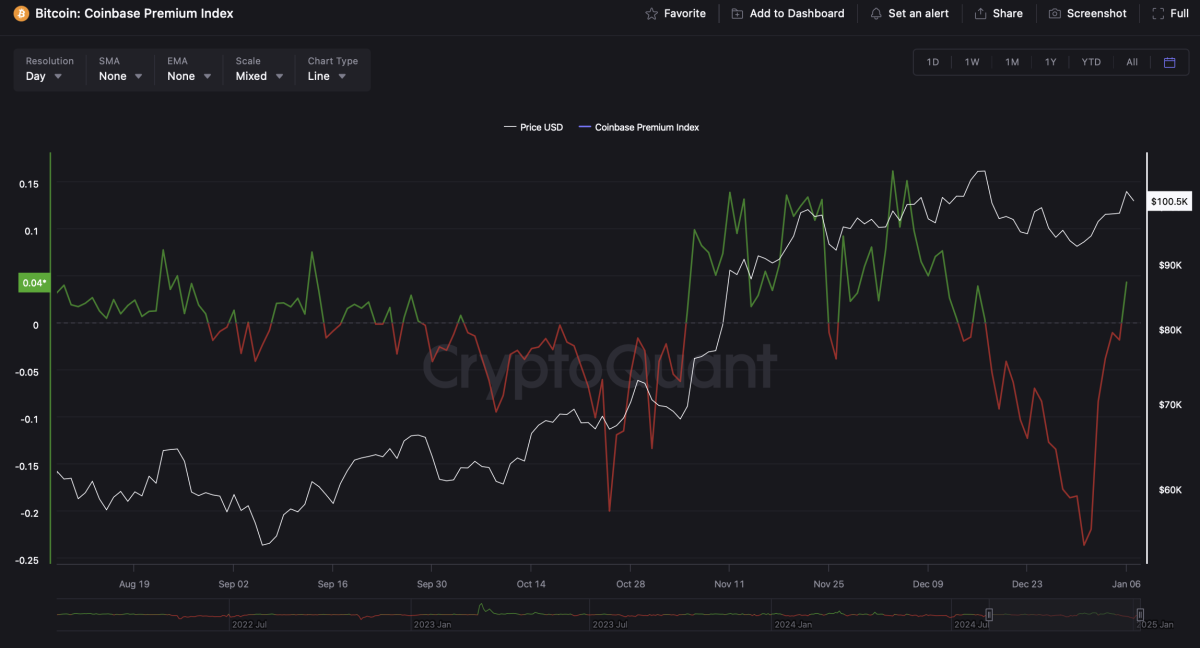

Coinbase premium flips positive for first time in weeks, indicating rising bitcoin demand from US investors

The Coinbase Premium Index (CPI) has turned positive for the first time since mid-December 2024, signaling renewed demand from U.S. investors, according to CryptoQuant analysis.

"Since the approval of U.S.-based spot bitcoin ETFs, the behavior of U.S. investors has been a leading indicator for the crypto market," CryptoQuant analyst Burak Kesmeci said. "The data suggests that U.S. investor behavior is once again shifting toward a dominance of buying pressure."

The positive premium on Coinbase suggests increased buying interest, especially from institutional players who use Coinbase for large transactions, Kesmeci said. "Alongside the CPI turning positive, a single block outflow of 4,012 bitcoin was recorded from Coinbase at 18:04 local time on Monday," the analyst noted.

The Coinbase premium has flipped positive for first time in weeks, indicating rising bitcoin demand from U.S. investors. Image: CryptoQuant.

Tightening liquidity and miner behavior support bitcoin's uptrend

Bitfinex analysts pointed to several metrics suggesting that much of the downward pressure that pushed bitcoin to a local low of $91,000 in late December may now be easing.

"Bitcoin's sell-side liquidity is shrinking at a rapid pace," the analysts said. They referenced the Liquidity Inventory Ratio (LIR)—a metric measuring how long the current supply can meet demand—which plunged from 41 months in October to just 6.6 months now. This sharp decline in liquidity mirrors the trends seen during strong rallies in the first and second quarters of 2024, indicating tightening supply as demand grows.

The analysts also highlighted changes in miner activity, a key driver of bitcoin's spot market. Following the 2024 halving event, where mining rewards were cut in half, many miners had to sell their reserves to raise capital for operations and equipment upgrades. However, according to Bitfinex, this selling pressure is diminishing as 2025 begins.

"Bitcoin flows from miners to exchanges are declining rapidly," the analysts said, suggesting that miners are increasingly holding onto their bitcoin rather than selling.

Miner profitability rises but still below pre-halving levels

Additionally, a report by JPMorgan, cited by CoinDesk, showed that bitcoin miner profitability rose for the second consecutive month in December 2024, reaching its highest level since April 2024. However, despite this improvement, miners' daily income and gross margins remain 43% and 52% lower, respectively, than levels before the halving.

According to Coindesk, JPMorgan estimated that in December, bitcoin miners earned an average of $57,100 per exahash per second (EH/s) in daily block reward revenue last month, 10% more than in November.

The bitcoin network hashrate grew by 6% in December to an average of 779 EH/s, the report said. However, this growth rate was considerably slower than the 103% increase observed in 2023.