Ethereum staking defies market trends with robust growth in 2024

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum staking continues to grow this year despite the emergence of spot exchange-traded funds (ETFs) and the digital asset’s price relative price weakness.

On Oct. 8, blockchain analytics firm IntoTheBlock reported that Ethereum staking rose by 5.1% this year, with 28.89% of the total ETH supply now staked, up from 23.8% in January.

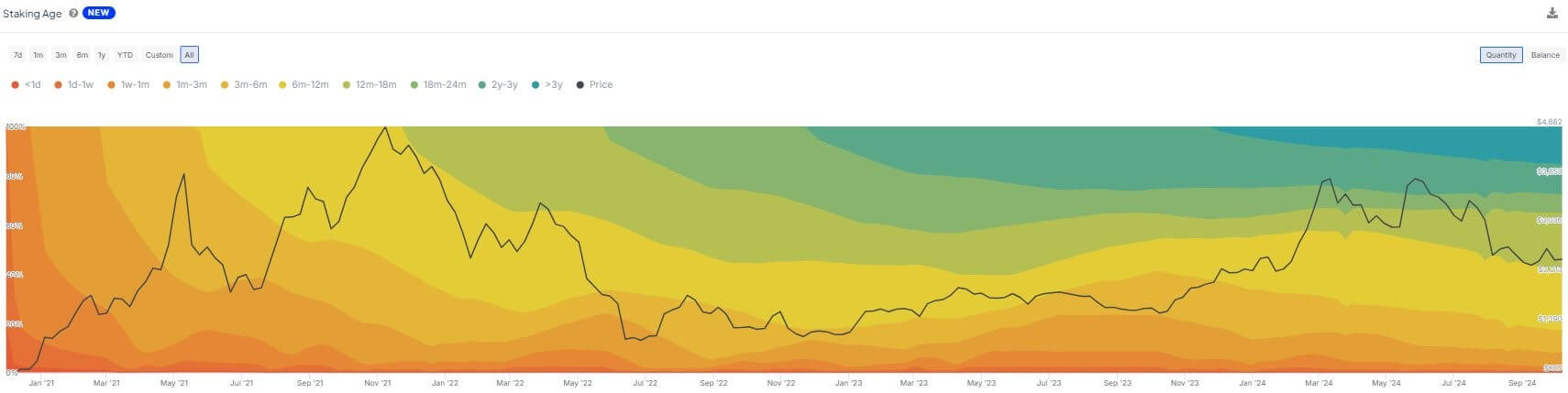

Dune Analytics data estimates that there are currently around 37.79 million ETH staked, worth approximately $84.8 billion, contributed by over one million validators. IntoTheBlock also reports that 15.3% of this staked ETH has been locked for at least three years, reflecting strong investor confidence in Ethereum’s long-term potential.

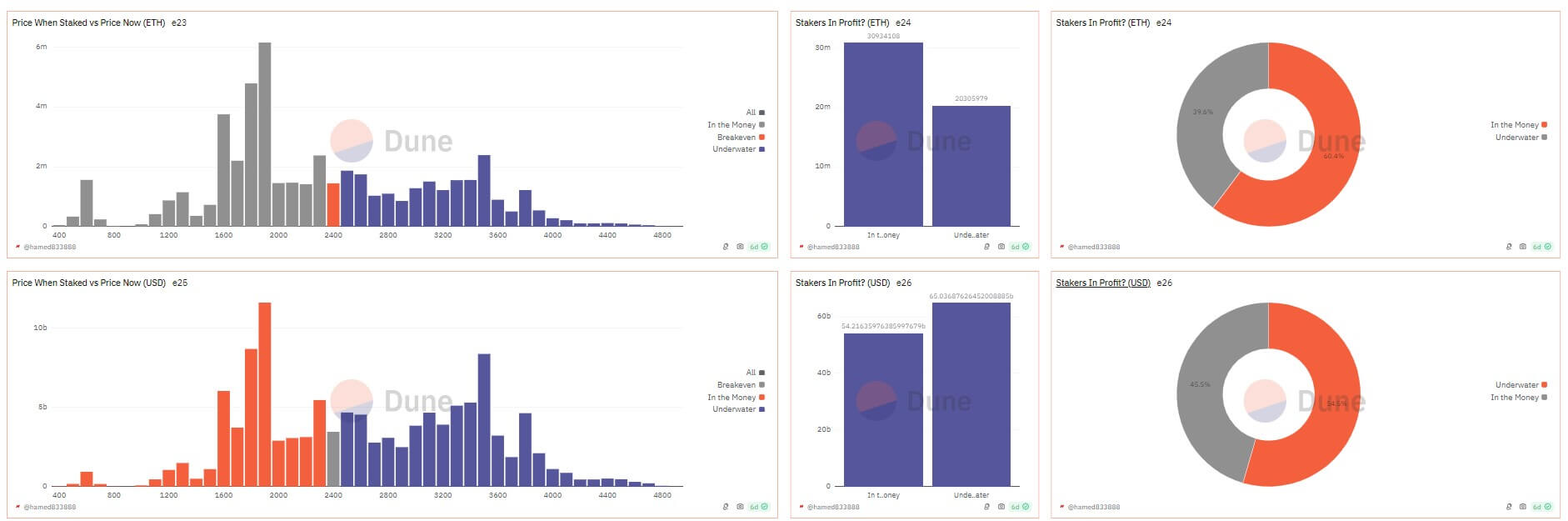

Despite the rise in staked ETH, Ethereum’s price growth has been modest compared to competitors like Solana. While Ethereum’s price is up about 6% year-to-date to $2,447, Solana has surged 41% in the same period.

Staking profitability

Staking, which involves locking up ETH to validate transactions in exchange for rewards, is central to Ethereum’s proof-of-stake (PoS) system. This process has attracted both institutional and retail investors, offering them the chance to earn yields on their staked ETH.

Dune Analytics data shows that about 60% of stakers are in profit, despite the asset’s price challenges. The realized price for staked ETH is around $2,265, while its current market price is $2,432, translating to a 7% profit margin for stakeholders.

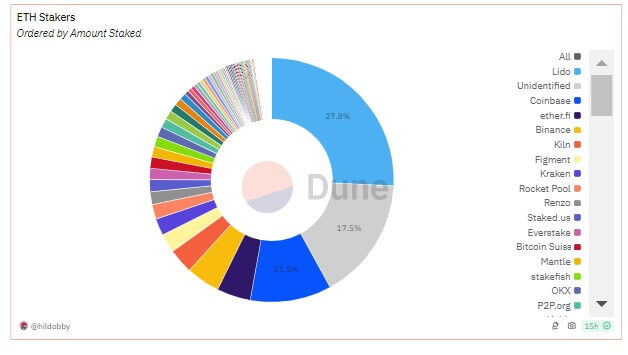

Lido, a leading liquid staking platform, holds the largest share of Ethereum staking, with 9.7 million ETH staked, valued at roughly $24 billion at current prices.

Among centralized staking providers, Coinbase leads with 11% of the total stake, holding over 4 million ETH. Binance, which offers lower commissions, controls 4.75%, or 1.6 million ETH. Other platforms, such as Ether.fi, Kiln, Figment, and Kraken also hold significant market shares. Altogether, centralized exchanges account for 18.5% of the Ethereum staking market.

Recently, Ethereum co-founder Vitalik Buterin suggested lowering the minimum ETH requirement for solo staking. If implemented, this move could attract more participants and further contributing to the growth.