Weekly Overview: What Happened in GameFi, NFTs, and Metaverse This Week? [June 9-16]

We collect this week’s highlights on NFTs, play-to-earn, and metaverse which are the main topics we hear more and more details about every day.

For those who do not want to miss the most influential news about the industry among dozens of news, we have compiled the top five of this week for you.

Brink Receives $5 Million Pledge from #startsmall for Bitcoin Development

Image Credit: bitcoinmagazine

Image Credit: bitcoinmagazine

Brink, a nonprofit organization focused on Bitcoin development, has received a substantial financial pledge of $5 million from #startsmall, an organization founded by Jack Dorsey. This commitment of $1 million annually for the next five years will provide a solid foundation for Brink’s mission of supporting Bitcoin developers and ensuring the long-term sustainability of the Bitcoin core codebase.

Brink’s initiatives, including fellowships, grants, and mentorship programs, aim to foster open-source development for Bitcoin and related technologies, strengthening the Bitcoin network and developer ecosystem. The support from #startsmall will enable Brink to attract more talent, expand educational initiatives, and provide ongoing assistance to Bitcoin developers in their crucial work.

The pledge from #startsmall not only emphasizes the growing significance of Bitcoin and its underlying technology but also showcases #startsmall’s dedication to open-source projects. This substantial funding injection will empower Brink to create a sustainable environment for Bitcoin development, furthering their efforts to advance the Bitcoin ecosystem and decentralized systems.

Arbitrum Introduces Layer-3 XAI Network to Revolutionize Web3 Games

Image Credit: Offchain Labs

Image Credit: Offchain Labs

Arbitrum has introduced a revolutionary Layer-3 XAI network, specifically designed to empower Web3 games, according to a recent article by Decrypt. This cutting-edge network aims to overcome scalability and cost challenges faced by blockchain-based games, promising a seamless and efficient gaming experience.

The Layer-3 XAI network leverages Arbitrum’s advanced technology to enhance the performance and scalability of Web3 games. By utilizing off-chain computations, it significantly reduces transaction fees and accelerates transaction processing, ensuring smoother gameplay for users.

Arbitrum’s Layer-3 XAI network builds upon its successful Layer-2 scaling solution, which has gained traction in the blockchain community. The latest offering aims to provide developers and gamers with a robust infrastructure to create intricate, immersive, and highly interactive Web3 games.

The introduction of the Layer-3 XAI network aligns with the increasing demand for blockchain gaming and the broader adoption of Web3 technologies. By offering improved scalability and affordability, Arbitrum’s solution is expected to attract more developers and users to the Web3 gaming ecosystem, fostering innovation and propelling the industry forward.

Arbitrum’s commitment to advancing the Web3 gaming space positions it as a key player in the blockchain gaming arena. The Layer-3 XAI network represents a significant stride towards realizing scalable and engaging Web3 games, unlocking new possibilities for developers and players alike.

Overall, the launch of Arbitrum’s Layer-3 XAI network signals an auspicious future for Web3 gaming. By addressing scalability hurdles and providing a more cost-effective infrastructure, Arbitrum contributes to the growth and evolution of blockchain gaming, paving the way for an era of immersive and decentralized gaming experiences.

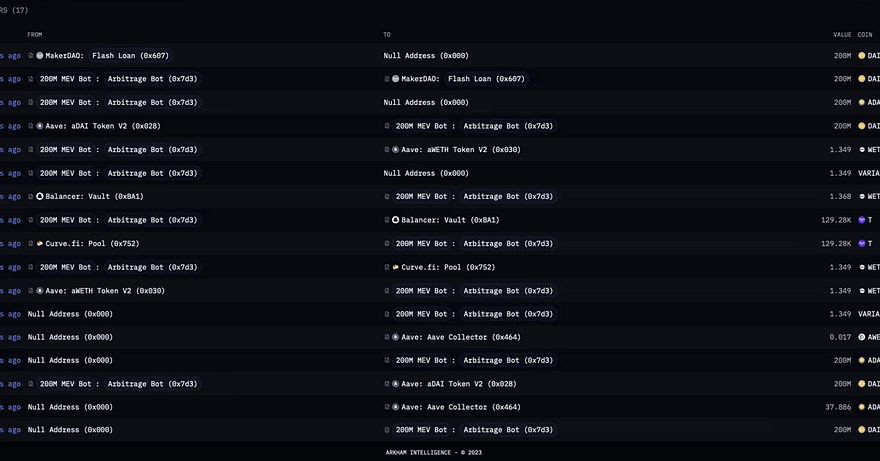

Flash Loan Arbitrage Bot Generates $3.24 Profit After Borrowing $200 Million in DAI

An arbitrage bot made waves in the crypto world after successfully executing a flash loan valued at $200 million in the DAI stablecoin from MakerDAO. This innovative strategy resulted in a profit of $3.24 after factoring in transaction fees. Leveraging MakerDAO’s ‘DssFlash’ contract, the bot seized the opportunity to borrow 200 million DAI tokens without incurring any fees. It then utilized these tokens to secure a loan of $2,300 worth of wrapped ether (WETH) on Aave.

Next, the bot swiftly traded the acquired WETH for Threshold Network on Curve, followed by selling it on Balancer through a series of rapid transactions within a single block. Although the total profit amounted to $33, the transaction and protocol fees consumed nearly $30, resulting in a net profit of $3.24.

The relatively small borrowing amount of $2,300 may be attributed to limited liquidity, which could have impacted the overall gains. It is worth noting that flash loans have gained attention for their potential misuse within the decentralized finance (DeFi) space. Previous incidents involving flash loan exploits on platforms like Platypus and 0VIX have resulted in losses exceeding $10 million.

Digital Art Collection from Defunct Crypto Hedge Fund Sells for Millions at Sotheby’s Auction

A woman looks at a NFT by Ryoji Ikeda titled “A Single Number That Has 10,000,086 Digits” on June 4, 2021, at Sotheby’s. Photo: AFP

A woman looks at a NFT by Ryoji Ikeda titled “A Single Number That Has 10,000,086 Digits” on June 4, 2021, at Sotheby’s. Photo: AFP

One of the notable highlights of the recent auction conducted by Sotheby’s was the sale of a digital art collection that previously belonged to a defunct crypto hedge fund. This collection, curated by Three Arrows Capital (3AC) in 2021, comprised highly sought-after non-fungible tokens (NFTs) that hold immense value in the crypto space.

One particular standout from the auction was “The Goose,” a digital artwork created by Dmitri Cherniak, which portrays a golden goose laying eggs. Back in August 2021, 3AC had acquired this piece for 1,800 Ether, equivalent to approximately $5.8 million at that time. Sotheby’s successfully sold it for around $5.4 million, with additional fees, resulting in a total sale price surpassing $6.2 million.

Among the other notable NFTs in the collection were three CryptoPunks and one Autoglyph from Larva Labs, both renowned and iconic projects on the Ethereum blockchain. The CryptoPunks fetched prices ranging from $75,000 to $90,000 each, while the Autoglyph commanded a price of $120,000.

The sale of this defunct crypto hedge fund’s digital art collection by Sotheby’s signifies the growing interest and value placed on NFTs. The auction showcased the allure of these unique digital assets and their ability to attract significant sums from collectors and investors in the crypto community.

SoundXYZ Strikes a Chord: Music NFTs with Optimism and Innovation

Image Credit: nftplazas

Image Credit: nftplazas

SoundXYZ is leading the way in embracing the potential and enthusiasm surrounding music non-fungible tokens (NFTs), as highlighted in a recent article on Cryptopolitan. The platform acts as a vital bridge between musicians and blockchain technology, creating an environment where optimism for music NFTs can thrive.

SoundXYZ utilizes the power of blockchain to revolutionize the music industry by transforming the creation, distribution, and monetization of music. Through their decentralized marketplace, musicians can tokenize their work as NFTs, granting them greater control, transparency, and ownership over their intellectual property.

By incorporating smart contracts into the NFTs, musicians can automatically and transparently receive royalty payments whenever their music is purchased or streamed. This empowers artists to establish sustainable income streams while maintaining a direct connection with their fan base.

SoundXYZ also focuses on fostering a vibrant community of music enthusiasts and collectors. By offering unique music NFTs, fans have the opportunity to directly support their favorite artists and engage in a new form of music ownership. This creates a sense of exclusivity and value within the music NFT ecosystem, strengthening the bond between artists and their audience.