Bitcoin Price Analysis: 2025 Will Be “Explosive” – Here’s Why

Bitcoin has surged 8.01% over the past three months, with a notable 13.9% rise in the last 30 days alone. Despite this upward trend, the market is still recovering from a dip on October 1, caused by tensions between Israel and Iran. However, a recent post by cryptocurrency expert Bob Loukas on X has sparked fresh optimism. He urges traders to take a broader view, focusing on Bitcoin’s four-year cycle—a key factor that could point to explosive growth.

So, what does Loukas’s analysis reveal?

Bitcoin’s Four-Year Cycle: A Sign of Big Gains Ahead?

Loukas’s analysis shows that Bitcoin is nearing the end of the second year in its current four-year cycle.

Last year, Bitcoin saw a price jump of +155.4%. This year, so far, it’s up by +47.7%. According to Loukas, the third year in Bitcoin’s cycle often brings strong growth, suggesting that next year could see ‘tremendous gains.’

Does History Back Loukas’s Prediction?

In the third year of the previous cycle, the market reported a price change of +59.6%. In 2017 and 2013, the market displayed +1,369% and +5,435%, respectively. Since 2011, the market has seen at least three complete cycles, and the latest is the fourth one.

Notably, in the first and the second cycles, the third year was the best performer in terms of price change. In the third cycle, the second year of the cycle, with +304.1%, and the first year, with +90.9%, outperformed the third. However, the previous cycle’s deviation from the pattern was not surprising, as that cycle occurred during the COVID-19 crisis.

Bitcoin Market Analysis

Loukas points out that over the past 8 months, the Bitcoin market has built a solid base.

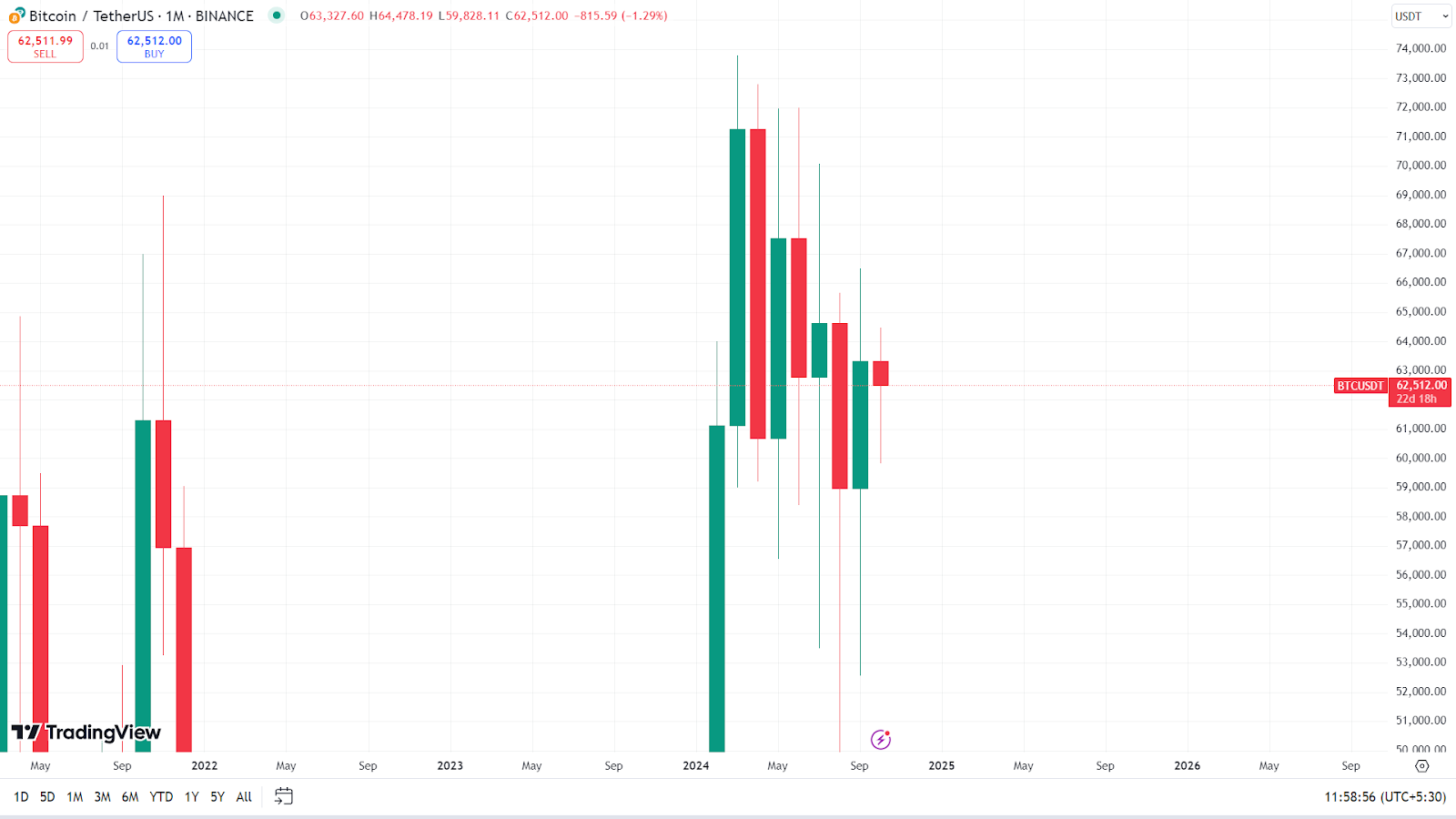

This year’s one-month chart shows the formation of four long bullish candlesticks, with the longest appearing in February. Since March, Bitcoin’s price has been moving between $71,319 and $58,938. Loukas believes this consolidation has created a strong support base for the next upward move.

Loukas also highlights how the global trend of lowering interest rates is creating a favorable environment for Bitcoin. Lower interest rates often drive more investment into riskier assets like cryptocurrencies, adding to the bullish outlook.

2025: Bitcoin’s Explosive Growth Year?

In summary, Loukas’s analysis gives a solid reason to expect strong bullish momentum for Bitcoin as we move toward 2025. With historical patterns in its favor and a supportive economic backdrop, Bitcoin could be on the verge of another explosive growth phase.