Animoca reports $68 million of Q3 revenue, and $2.2 billion in total assets

Animoca Brands has released its latest investor update including key unaudited financial and business highlights for Q2 and Q3 2024.

Year-to-date bookings in Q3 was $209 million, indicating a solid performance during a volatile year in which much of the market was still improving from 2023. At the end of the quarter, Animoca Brands had $248 million in cash and stablecoins, $330 million in liquid third-party digital assets, and $1.6 billion in off-balance sheet token reserves, totaling around $2.2 billion.

During the final stretch of 2024 however, the value of Animoca’s combined crypto assets has increased significantly, up around 40%, thanks to the general improvement in crypto prices. The US presidential election in November is considered to be the main factor driving this growth.

In the same period, on 16th December, Mocaverse’s MOCA Coin was listed on two major South Korean exchanges resulting in a 24-hour trading volume of more than $2 billion.

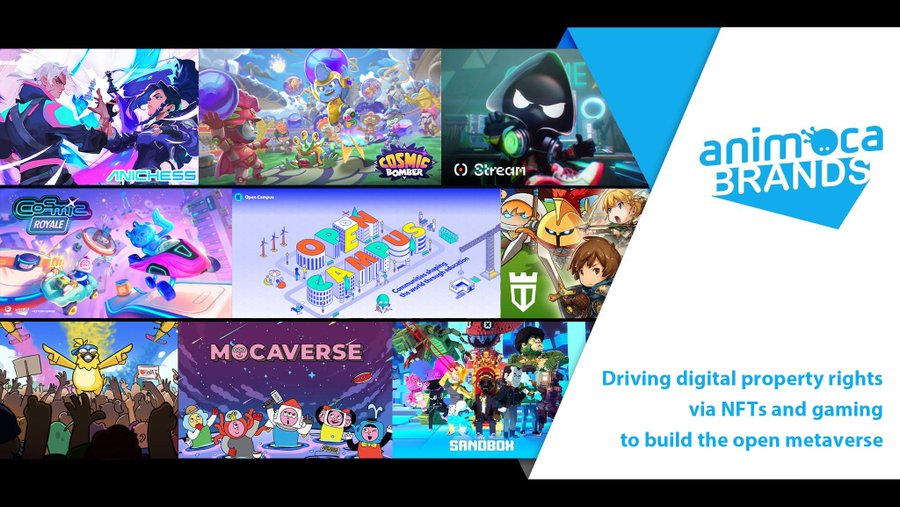

More specifically, bookings of $69 million were recorded in Q3 2024, and $48 million in Q2 2024. Of these, the biggest chunk, $39 million in Q3 2024 and $14 million in Q2 2024, was generated from businesses of subsidiaries as well as projects incubated by Animoca Brands. Including Mocaverse, Open Campus, Gamee, The Sandbox, and Anichess, the revenue was generated through activities such as token sales, in-app purchases, and other non-blockchain sales.

Furthermore, YTD Q3 2024 the company invested in around 60 new projects and realized $28 million from its token specific investments.

Some of its notable Q2 and Q3 investments include Aethir, Carv.io, Gunzilla, Nillion, Abstract Chain, and Pudgy Penguins headco Igloo.