Solana apes Bitcoin’s early 2024 pattern – New ATH for SOL in Q1 2025?

Solana’s (SOL) price action chart juxtaposed with its short-term risk index where it rebounded from a consistent level in recent bull runs. This pattern suggested a potential floor for risk aversion among traders. Historically, each time the risk index HAS hit this low, a price recovery ensued on the charts.

In fact, this consistent behavior indicated that SOL’s current position could precede another upward movement.

These historical patterns, together, gauged potential entry points, and suggested that Solana could soon see a price hike if the trend holds true.

This analysis, rooted in past historical trends, supported a cautiously optimistic outlook for SOL’s short-term performance – Potentially enhancing its market position.

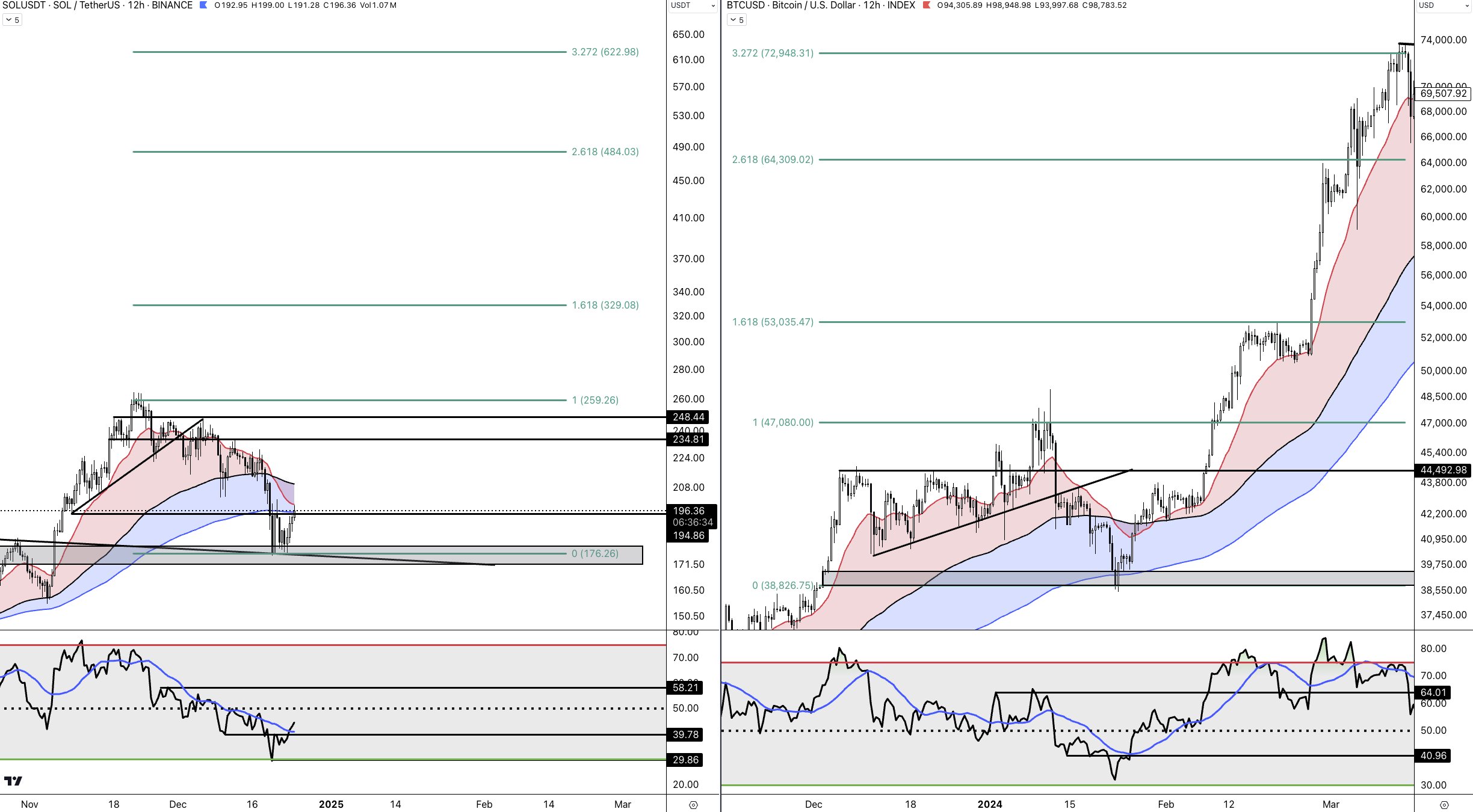

Solana apes Bitcoin’s early 2024 pattern

Solana also mimicked Bitcoin’s early 2024 trajectory, which saw BTC hitting new all-time highs. During this time, Bitcoin soared from $47,080 to $74,000, driven by significant buy-ins at critical support levels around $45,000.

Similarly, Solana has exhibited a similar pattern, bouncing off a crucial support level near $193.84, one marked by the intersection of historical resistance transformed into support.

This replication suggested that SOL could pursue a similarly exponential rise as Bitcoin, with the key resistance potentially breaking to fuel further gains.

This indicated that if Solana continues to follow this path, it could target the next resistance level near $248.44, coinciding with a key Fibonacci retracement zone. Should momentum mirror Bitcoin’s, breaking past this level could push SOL towards $328.98 and beyond – Replicating Bitcoin’s ascent.

Simply put, this analysis alluded to a predictive outlook, one where SOL could hit new heights – Mirroring Bitcoin’s historical performance during a comparable period.

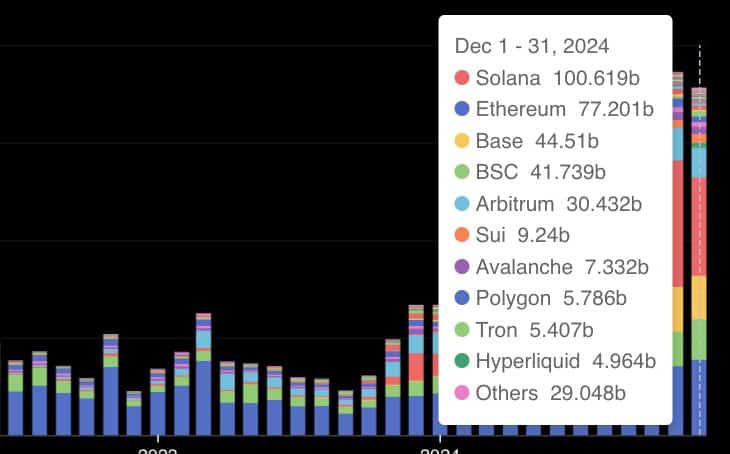

Surge in DEX volume amid altcoin season

Additionally, Solana’s dominance in DEX volume has been evident lately, surpassing $100 billion for another month. It continued to lead other chains too. Ethereum followed with a trading volume of $77.201 billion – A sign of a competitive, but lower performance.

Other platforms like Base and Binance Smart Chain (BSC) reported volumes of $44.51 billion and $41.739 billion, respectively, further highlighting Solana’s market lead.

Smaller chains like Arbitrum, Sui, and Avalanche contributed $30.432 billion, $9.24 billion, and $7.332 billion, respectively. These findings were a sign of their growing, but still modest share in the DEX market.

Finally, the anticipated altcoin rally projected an uptrend in the total market cap, specifically highlighting an altcoin season.

This pattern suggested that SOL, while already exhibiting bullish tendencies, could benefit significantly as market conditions favor altcoins.

With the market cap surpassing $3.36 trillion, the environment appears to be ripe for a Solana rally right now. Especially in the first quarter of 2025. This could potentially drive SOL to new highs, paralleling or even surpassing its previous peaks.

Monitoring Solana closely is crucial as it could mirror or capitalize on the broader altcoin surge, enhancing its valuation and market position.